Real Estate Market Update From Merri Ann Simonson

Posted July 12, 2017 at 5:30 am by Peggy Sue McRae

Merri Ann Simonson – Contributed photo

SAN JUAN REAL ESTATE MARKET SUMMARY

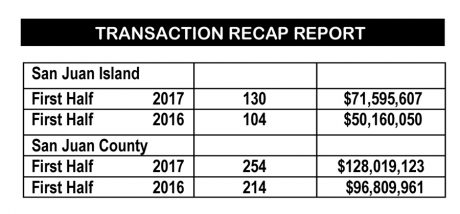

The second quarter results which complete the first half of the year for San Juan Island were very exciting. Per the NWMLS, the dollar volume on San Juan Island was $71,595,607 with a total of 130 transactions. We enjoyed a 25% increase in transaction number and a 42.5% increase in dollar volume as compared to the same period in 2016. For San Juan County, the total dollar volume was $128,019,123 with a total of 254 transactions. The County’s gain was 19% in transaction number and 32.5% in dollar volume.

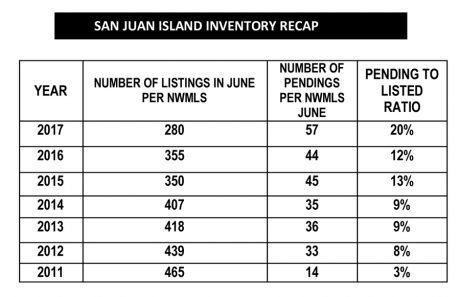

One very notable contributing factor to the increase in volume is the recovery of our market in the category of lots and acreage. Land sales were the slowest to recover but this quarter reflects an improvement of 56% in the transaction number over the same period in 2016 for San Juan Island. The County’s land sale transaction number reflects a 23% improvement. I attribute this to buyers not being able to find an existing home suitable to them, due to low inventory levels. Total inventory on San Juan Island for all property types as of July 11, is 280 of which, 57 are pending which is a decrease of 21% from June 2016 levels.

It is very encouraging to have recovery in the land segment of our market. Land sales equate to busy architects, designers, permitting and land use consultants, general contractors, interior designers, landscape architects, and subcontractors, just to name a few.

The only segment of our market that still lacks recovery is the waterfront lot sales. Their desirability is less than that of a water view parcel because an owner is not able to enhance views due to shoreline buffer protection.

Sales in excess of more than $1 M have been stable. Year-to-date in the County, we have had 18 sales as compared to the 17 for the same period in 2016. I guess you can’t believe everything you read in the Wall Street Journal. San Juan enjoyed 12 of the sales, Orcas had 4, and Brown and Shaw Islands each had 1. Currently 16 high-end sales are pending in the NWMLS for the County which is slightly higher than the number in 2016, which is a good trend. The Wall Street said we were the hottest high-end market in the nation, but I don’t agree, we are healthy. We have a good level of high-end listings, but I have always defined how “hot” a market is based on closings, not listings.

Another positive trend in our market is the average percentage off list price that sellers are negotiating is reducing. For the first 6 months in 2016, sellers negotiated on average 7.7% on homes and 10.4% on land. For the first half of 2017, sellers negotiated 5.2% for homes and 7.3% for land.

We have also had more multiple offers this year than last which of course is attributed to a lower level of inventory. How do sellers respond to a multiple offer situation you might ask? The short answer is; any way they want to. The misconception is “first in first right”, which is not the case.

MULTIPLE CONCURRENT OFFERS

It is the policy at Coldwell Banker San Juan Islands that when a multiple offer situation presents itself, typically the agent will notify the seller that more than one offer will be presented and he/she should defer any decision until all offers have been presented, if possible.

After all offers have been presented, seller is advised of their options; accept or counter the best offer, simultaneous counter offers or the auction process.

If seller decides to work with one offer, he/she may accept one of the offers “as is” (make no changes) or propose other terms to that buyer in the form of a counter offer. The seller should be advised to take no action on the other offers until the seller completes negotiation on the chosen offer to completion; whether it is accepted or rejected.

If the seller insists on making simultaneous multiple counter offers, the following language must be used in all such offers: “This counter offer is being made with the understanding that it is being made to more than one prospective buyer and that acceptance hereof shall be of no force or effect until the acceptance of buyer is both delivered in writing to the seller and is acknowledged by seller in writing.” In such a case, the listing agent communicates to all selling agents that simultaneous counter offers were made.

If the seller elects to solicit an increase in bids from the various purchasers, there are several methods in which this can be conducted. CBSJI recommends that a written bid process be used. With the seller’s instruction, the agent may conduct a bid process verbally until the top bidder is proven, keeping in mind that a verbal transaction is not binding. With the seller’s instruction, the listing agent may communicate to the selling agents, the price and terms of all offers involved in the competition. Upon completion of the process, the agent must still submit all written offers to the seller for their records. Seller should mark all unaccepted offers with REJECTED and initial and date to evidence seller reviewed the offers.

If the seller elects, a silent bid is another option. The listing agent will contact all selling agents and advise them of the multiple offer situation and encourage them to have their buyer perfect their offer. No terms are disclosed. Again, the offers are bid against each other until the top bidder is proven.

The open bid, where all buyers are aware of the terms of the top offer appears to be the most fair. That way each buyer can step aside at the time they have reached their top price, versus guessing at what the best price should be and missing out. Often they find out later that they missed by only $1,000 which can happen in the silent auction option.

Multiple concurrent offers are not a regular event in our market, yet . . . . . . .they tend to create only two happy players involved in the outcome and the rest are disappointed.

All of the trends are in the right direction; low inventory levels, increasing transaction numbers and dollar volume, and very busy agents; our real estate market is healthy. As part of a healthy market, buyers are able to process their due diligence and determine if the property is suitable, which is a good practice for all parties. Due to inventory levels, some sellers are selling in a timely manner and working with motivated buyers which results in receiving a decent price.

You can support the San Juan Update by doing business with our loyal advertisers, and by making a one-time contribution or a recurring donation.

Categories: Around Here

No comments yet. Be the first!

By submitting a comment you grant the San Juan Update a perpetual license to reproduce your words and name/web site in attribution. Inappropriate, irrelevant and contentious comments may not be published at an admin's discretion. Your email is used for verification purposes only, it will never be shared.