The Real Estate Market and your Tax Assessment

Posted January 15, 2015 at 4:26 pm by Tim Dustrude

Here’s another informative article written by Merri Ann Simonson…

Merri Ann Simonson

All of us Island property owners received our tax assessment notices from the County in November. As real estate agents we have been fielding many questions about the statements and new assessments. As you may recall, the State has mandated that our Assessor’s office convert to an annual assessment update cycle versus the cyclical system we were on for years. The current values are for a one year period only and will be adjusted the next year. This process is much more stable and refined and will be a more accurate system than we have had in the past.

As agents, we have seen properties sell above their tax assessments the majority of the last 20 years with the exception of 2008-2012. Most of the variance was due to the lag time that accompanied the previous cyclical schedule our assessor used.

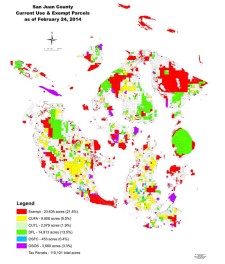

Map of Exempt Parcels in 2014 – Click to enlarge (Note: You can also see a full sized PDF of this map via a link at the end of the article).

During a few years of the recession, properties were selling at or below the assessor’s values. For example, back in 2006, many of the same type properties sold in an average range of 125%-150% over their tax assessments.

During the recession, many properties sold in an average range of 15%-30% below their tax assessed values. These average percentages varied based on the type of property but generally that was the trend.

In 2014, due to market recovery, most homes are again selling slightly above their tax assessment. Due to annual re-valuations and the new assessor’s appraisal method, we may not have as extreme variances in the future.

Reviewing the tax assessment as compared to the actual sale price for high-end homes is not reliable as they are very difficult to appraise due to custom features.

Most of the confusion around the issuance of new tax assessments stems from the purpose and process of the tax assessment. The assessor is required to value properties for tax purposes at true and fair market value. The valuation assigned by a REALTOR for the purpose of marketing or the value assigned by an appraiser for the purpose of lending, estate planning or probate purposes, will most likely be a different amount. The process to the valuation is different for each therefore, the results will vary. Generally, the differences in the process are described below:

Appraiser and Agents:

Conducts an interior inspection then identifies at least 3 or more truly comparable sales that are recently closed that they either physically inspect or at minimum view via photographs in the Northwest Multiple Listing Service. Ideally closed sales should be less than 90 days old. They spend much more time on the property determining the desirability based on the features and amenities. They also rely upon a cost approach but a depreciation figure is deducted based on the age of the home and its condition. They will analyze the income approach if applicable and base the value of docks at market.

Due to the size of our market, finding truly comparable property sales in our County has always been the challenge. A real estate agent even differs from an appraiser as we can actually use “Pending” transactions as comparable sales. We also consider the current level of similar inventory and absorption rate in the category to assist in pricing a property for the current market for our clients.

Assessor’s Office:

The assessor’s office performs appraisals for purposes of ad valorem taxation. This is part of the process for how we provide funding to all local government services, including schools, libraries, ports, fire districts, the hospital district, emergency medical services, cemeteries, state schools, parks, roads, sheriff and government

Appraisers that work in the assessor’s office generally use information gathered from site visits without the benefit of an interior inspection. The characteristics of the home and land are considered and compared on a “mass appraisal” basis to all other properties countywide, with statistical analysis of properties grouped by similar market influences and characteristics. The “mass appraisal” method provides more equal distribution of property taxes among property owners within the jurisdiction through standardization and improved consistency in the work of appraisers.

It is impossible with the size of our County, and the size of our assessor’s staff to physically inspect every property on an annual basis. The properties will be valued every year and the assessor’s appraiser will physically inspect one-sixth of the county properties each year. Since the Notices of Value mailed in November were based on a January 1, 2014 assessment date, our assessor’s office utilized sales from 2013 to develop statistical data with which to update the value of all the properties in San Juan County. After reviewing and validating those sales, they use approved appraisal practices to determine the percentage of increase or decrease in value in neighborhoods of similar properties. 2014 sales will be used in the next cycle of the process.

As the assessor’s office performs this process on an annual basis, the historic variances noted in the second paragraph of this article will not be as extreme. If properties are actually selling above or below assessed values, those sales will be the basis for a statistical update the following year.

The assessor’s office is currently revising their method for valuing docks and will be using a more market based approach. This is a major valuation change for docks. The office is also valuing new construction, additions and remodels in a much more timely fashion.

The assessor’s office is required to assess at market value but with the constraints of limited access cited above, the task is quite different as compared to an agent or appraiser. The assessor is not allowed to be a member of the Northwest Multiple Listing Service and use their database but they do use the various brokerage firm’s real estate websites to view details and interior photographs which is allowed by the Uniform Standards of Professional Appraisal Practices.

The variance between the tax assessment and the values produced by appraisers and agents is expected as the process defines it.

Appraisers do not rely upon the tax assessed value as an approach to their valuation at all. The uniform reports don’t even request the appraiser to provide the assessment information. The appraisers never compare value conclusions with the assessor’s office therefore they are not influenced by the assessments. Their assignment is to provide market value to the lender or client, not the tax assessed value. It is also important to note that appraisers can and do provide opinions of value as of any given date; the assessor’s office is required to value property as of January 1 of each year so the aging of the assessor’s information will always be an issue, especially in an active market.

Agents are not licensed appraisers and there is no regulation surrounding how they calculate a property’s value; there is no uniform calculation. Some agents use the assessed values as a benchmark only. They recommend a list price to a client by applying a percentage to the property’s current assessment that is derived from the average percentage of sales price to assessment of similar recent sales. Some agents don’t rely on the tax assessed value at all and don’t let it influence their recommendation for pricing because they know the assessor doesn’t necessarily have access to the interior of the improvements. Regardless of what an agent recommends, the ultimate pricing decision is made by the seller.

REALTORs must, however, comply with Article 1- Duties to Clients and Customers of the REALTOR Code of Ethics which obligates REALTORs to provide an honest opinion of market value.

Buyers, of course, are looking for the best price possible and will use the tax assessments when it favors them. As agents, we are able to explain to the buyers the differences in the process and how the value amount may vary.

Websites such as Zillow, Redfin, and Trulia rely upon the various County Assessor’s information and valuations to process their own calculation. Their values may be reliable in Metropolitan areas where subdivisions of very similar homes are bought and sold on a regular basis, but the website’s calculation of value performs poorly in small, low volume, custom construction markets such as San Juan County. Again, as agents, we are able to explain to buyers that the website calculators are not reliable in our County.

Bottom line, we should all be pleased that our assessor’s office appraises as fairly as possible and uses the methods advised by the Department of Revenue and defined by statute. The tax assessment appeal process is straight forward which allows property owners to present their petitions themselves. Further we historically have had the lowest levy rate in the state.

If your value assessment is adjusted downward your tax statement may not have a correlated downward adjustment. Each tax district submits a budget for its expenses as constrained by state law. The total of the amount requested is divided by the total assessed value of each district. This results in a levy rate for each district. Your taxes are a composite of the levy rates for each district in which your property resides multiplied by your current assessed value, divided by 1,000.

If all properties increased or decreased by approximately the same percentage, you would likely see very little change in your tax statement regardless of the increase or decrease in your value. This complies with Washington State laws that were formed for the sole purpose of insuring that local government can rely upon a predictable amount of revenue each year so they could process a balanced budget. If the tax revenue had large fluctuations the result would be chaos for the local government services.

Another factor to keep in mind when considering your tax bill is the number of acres and percentage of total acres in San Juan County that are either exempt or pay a reduced amount due to being in a special use program. The taxes that would have been paid by these properties are shifted to the taxpayers based on public policy decisions by the State and County legislature.

See the PDF map at the link below:

http://www.sanjuanislands.com/PDF/ExemptParcels2014.pdf

Article written by:

Merri Ann Simonson

Coldwell Banker San Juan Islands Inc.

PO 100 Friday Harbor WA 98250

You can support the San Juan Update by doing business with our loyal advertisers, and by making a one-time contribution or a recurring donation.

Categories: Around Here

No comments yet. Be the first!

By submitting a comment you grant the San Juan Update a perpetual license to reproduce your words and name/web site in attribution. Inappropriate, irrelevant and contentious comments may not be published at an admin's discretion. Your email is used for verification purposes only, it will never be shared.