Merri Ann Simonson – Contributed photo

Higher Tax Assessments Don’t Always Lead To Paying More Taxes

By Merri Ann Simonson, Managing Broker, Coldwell Banker San Juan Islands Inc

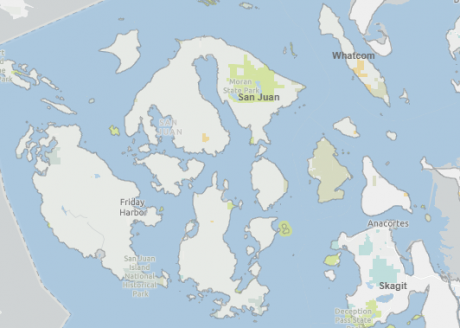

All of us island property owners received our tax assessment notices from San Juan County recently.

As real estate agents, we have been fielding many questions about the statements and new assessments.

As you may recall, the state has mandated that our county assessor’s office convert to an annual assessment update cycle versus the cyclical system we were on for years. The current values are for a one-year period only and will be adjusted the next year. The current process is much more stable and refined and is a more accurate system than we have had in the past.

For the last 20 years, the majority of the properties sell above their tax assessments with the exception of 2008-2013 which was the recession.

For example, during the recession, properties were selling at or below the assessor’s values. However, back in 2006, many of the same type properties sold in an average range of 125-150% over their tax assessments.

These average percentages varied based on the type of property but generally, that was the trend. Since 2014, due to market recovery, most homes are again selling above their tax assessment.

Reviewing the tax assessment as compared to the actual sales price for high-end homes is not reliable as they are very difficult to appraise due to custom features. The assessor relies on indications of value from market sales, and when there are not enough sales to determine the value of custom features, it is difficult to find an accurate standard of value for assessment purposes.

I do have to admit, as an agent, that processing an opinion of value for a home in excess of $2.5 million can be challenging; the owner typically builds a very custom home with an elaborate description of materials. Even licensed appraisers find it a challenge and some contact agents for more details.

Again, there are fewer sales of similar homes in that segment of our market so there are not as many comparable properties to review.

As always, it is much easier to be accurate when you have ample data to use.

The Purpose of the Assessments:

Continue Reading

By San Juan Community Theatre

By San Juan Community Theatre

By Fred Woods, Superintendent, San Juan Island School District

By Fred Woods, Superintendent, San Juan Island School District

By Skagit Valley College

By Skagit Valley College